🧾 2025 Federal Tax Numbers

The IRS has finalized a number of inflation-adjusted figures that will affect your tax return, retirement planning, and tax-smart decisions. Here’s a breakdown of the key numbers you should know.

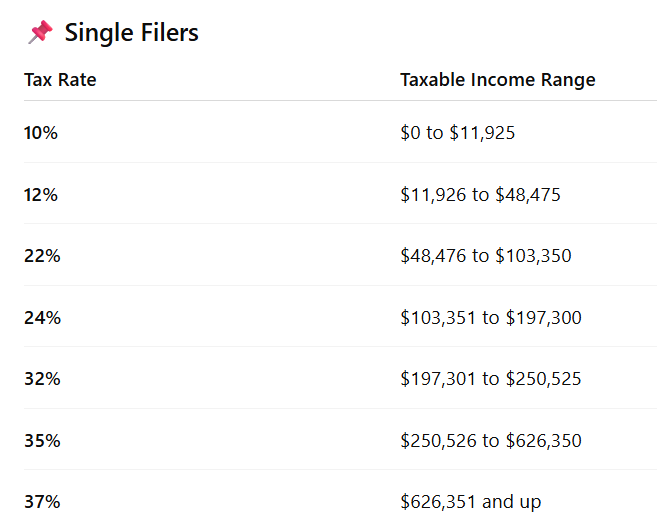

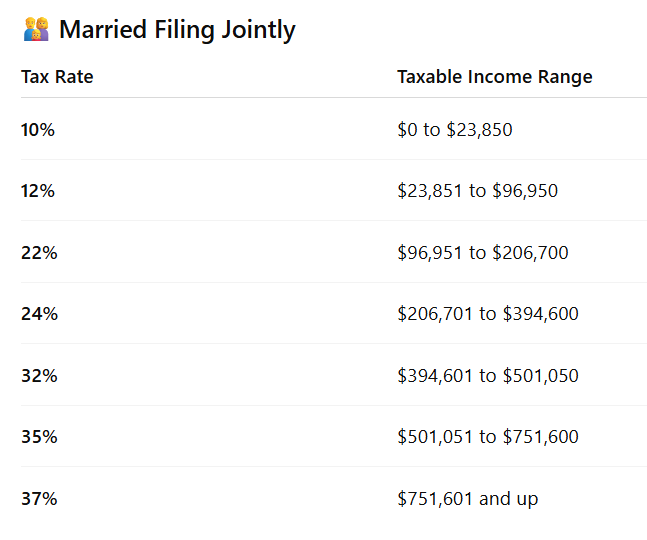

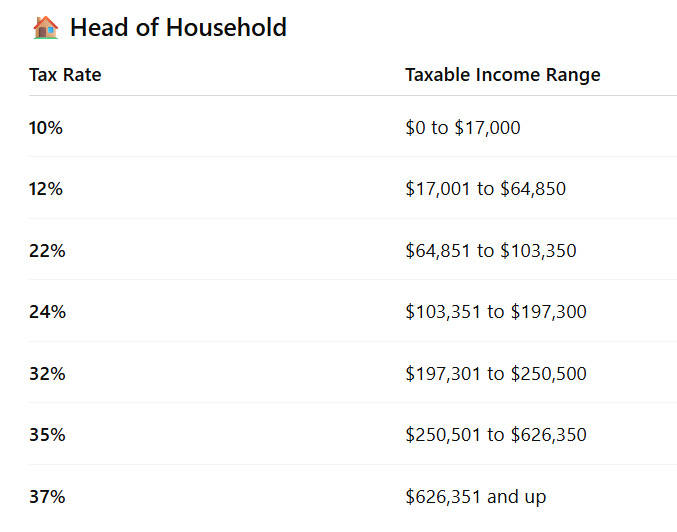

📊 Federal Income Tax Brackets (2025)

For the 2025 tax year, the U.S. federal income tax system continues with seven tax brackets ranging from 10% to 37%. These brackets are indexed for inflation each year, helping prevent “bracket creep.”

💡 How Tax Brackets Work

Rather than tipping your entire income into a higher rate, only the income within each bracket gets taxed at that rate.

Example:

If you’re single with $60,000 in taxable income:

The first $11,925 is taxed at 10% - $1,192.50

The next slice up to $48,475 is taxed at 12% - $4,386.00

Only the amount over $48,475 up to $60,000 gets taxed at 22% - $2,535.28

TOTAL TAX - $8,113.78

Tax Bracket is 22% but EFFECTIVE TAX RATE is tax/taxable income = 13.5%

This “layered” structure helps keep your average tax rate (a.k.a. effective rate) lower than your marginal rate.

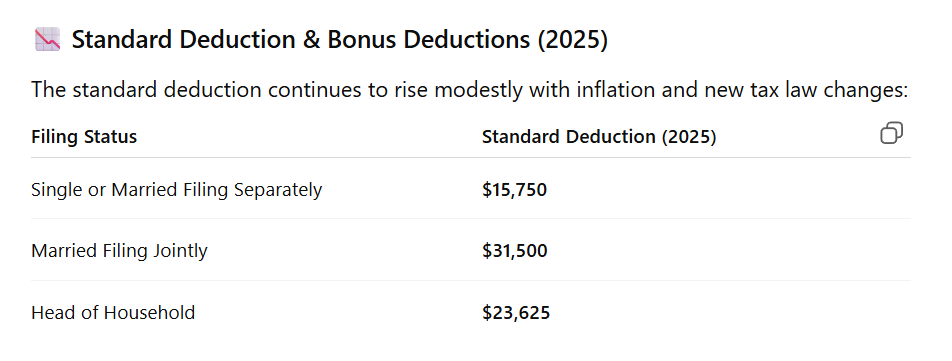

Additional Deductions for Seniors and the Blind:

Taxpayers aged 65+ or blind can each claim an additional $2,000 on top of the standard deduction. Under the 2025 tax law (the One Big Beautiful Bill Act), individuals 65+ can each take an additional $6,000 bonus deduction whether they itemize or use the standard deduction (subject to income phaseouts).

💼 Retirement Account Contribution Limits (2025)

Maximizing retirement contributions remains a great way to reduce taxable income and save for the future. Here’s what’s changed for the 2025 tax year:

IRA Contributions

$7,000 total IRA contribution limit for individuals under age 50.

$8,000 limit if age 50 or older (includes $1,000 catch-up).

This limit applies across all IRAs combined (traditional + Roth).

401(k), 403(b), 457 Plans

$23,500 elective deferral limit for 401(k) employee contributions in 2025.

Make additional catch-up contributions if you are 50 or older:

$7,500 extra standard “catch-up”

Up to $11,250 for ages 60–63 under SECURE 2.0 provisions (if your plan allows).

$70,000 combined employer + employee contribution limit (plus catch-ups where applicable).

These contributions include both traditional (pre-tax) and Roth options.

📌 Other Useful Limits & Info

SALT Deduction Cap: If you itemize, the limit on state and local tax deductions increased to $40,000 for individuals ($20,000 if married filing separately) for 2025.

Saver’s Credit: Income thresholds for the Retirement Savings Contributions Credit (Saver’s Credit) have increased modestly.