The 411 on 1099s

1099s are information forms that go to the IRS when certain payment thresholds are met.

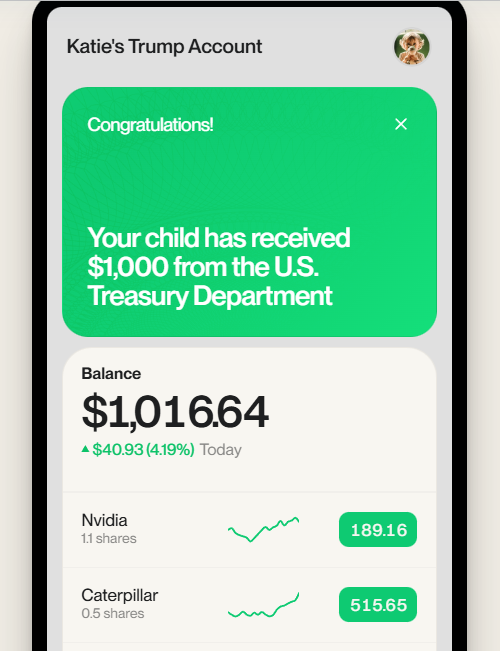

What the heck is a “Trump Account?”

All the info you need about opening a Trump account for your child.

🧾 2025 Federal Tax Numbers

Tax Year 2025 updated numbers including standard deduction, tax brackets, and more

Download Deb’s New Book - FREE!

Understanding the OB3: How the 2025 Tax Law Could Save You Money!

Why You Should Set Up Your IRS Online Account (And How It Helps You!)

To make managing your federal taxes easier and more convenient, we highly recommend setting up your IRS Online Account.

An IRS Online Account gives you direct, secure access to your own tax information — no waiting on hold or digging through old paper notices. Think of it like online banking for your tax records.

Watch Out for Tax Scams on Social Media

Navigating tax season can feel overwhelming—especially with misleading tax advice circulating on social media. The IRS has identified numerous hashtags and viral topics that promote inaccurate or fraudulent tax strategies, often targeting self-employed individuals and business owners. Many of these schemes misuse legitimate tax forms for the wrong reasons, putting taxpayers at risk of audits, penalties, or even legal consequences.

Here are some scams the IRS has flagged this year and how they might impact you.