The 411 on Tax Extensions

If you haven’t gotten your tax information together by this point (late-March as I write this), should you go ahead and file for an extension?

Filing for an extension gives you an additional 6 months to file your tax return. Your new deadline would be October 15. There is only one extension available. After October 15, your tax return would be considered unfiled until you get it filed, and then it would be late.

An extension is only an extension to file. It is not an extension to pay. The IRS still expects taxes to be paid in full by April 15th (more on that later). However, seeking an extension gives you more time to prepare a complete and accurate return if you’re doing it yourself and also gives your professional preparer some breathing room to ensure that they can provide you quality service and an accurate tax return.

Over the years, federal tax preparation has become increasingly complicated as the tax laws have become more complicated. The “official tax season” has also become much shorter. Most taxpayers do not receive all of their tax documents until mid to late February. The deadline is still April 15th, creating an incredibly short time period for professional tax preparers to prepare and file hundreds of tax returns. On top of that, throw in Congress teasing tax law changes (2024) or actually changing tax laws mid tax season (2020-2023). And, of course, we are dealing with technology, so we must deal with crashes, glitches, and upgrades from our professional software, and on and on. To say that it can be stressful is an understatement.

Are you a DIYer who is stressing out? Are you a business owner who doesn’t have your accounting ready? Maybe you’re still waiting to hear from your bookkeeper? You’re waiting on K-1s from a real estate partnership? (Some of those don’t arrive until the summer!) Are you looking for tax advice or a new tax preparer but none of them are accepting clients right now? File an extension!!

Even with a filing extension, your taxes (if you owe) are still due April 15th.

How do you know how much to pay by April 15 if you haven’t prepared the return? Well, you don’t. But there are ways to estimate an amount you should pay. If you don’t pay enough, you could be subject to penalties and interest. If you pay too much, you’ll get a refund!

Start here:

How much did you pay in during the year through withholding and/or estimated tax payments?

If you paid in during the year, do you usually get a tax refund? If so, you are on pretty solid ground.

If you usually OWE, then expect to owe again. In that case, you will want to pay in some money before April 15th.

If you are self-employed and haven’t been paying estimated taxes, then you definitely want to consider if you should make a payment, especially if your business was profitable and/or you owed self-employment tax last year.

If you received extra income in 2023 – retirement distributions, a home sale — then you will need to see if you will owe additional tax on that income.

Pay on Time with Safe Harbor

To avoid penalties, strive to pay 90% of your current liability or 100-110% of last year's tax (depending on income). This "safe harbor" method allows you to pay on time, even with an extension.

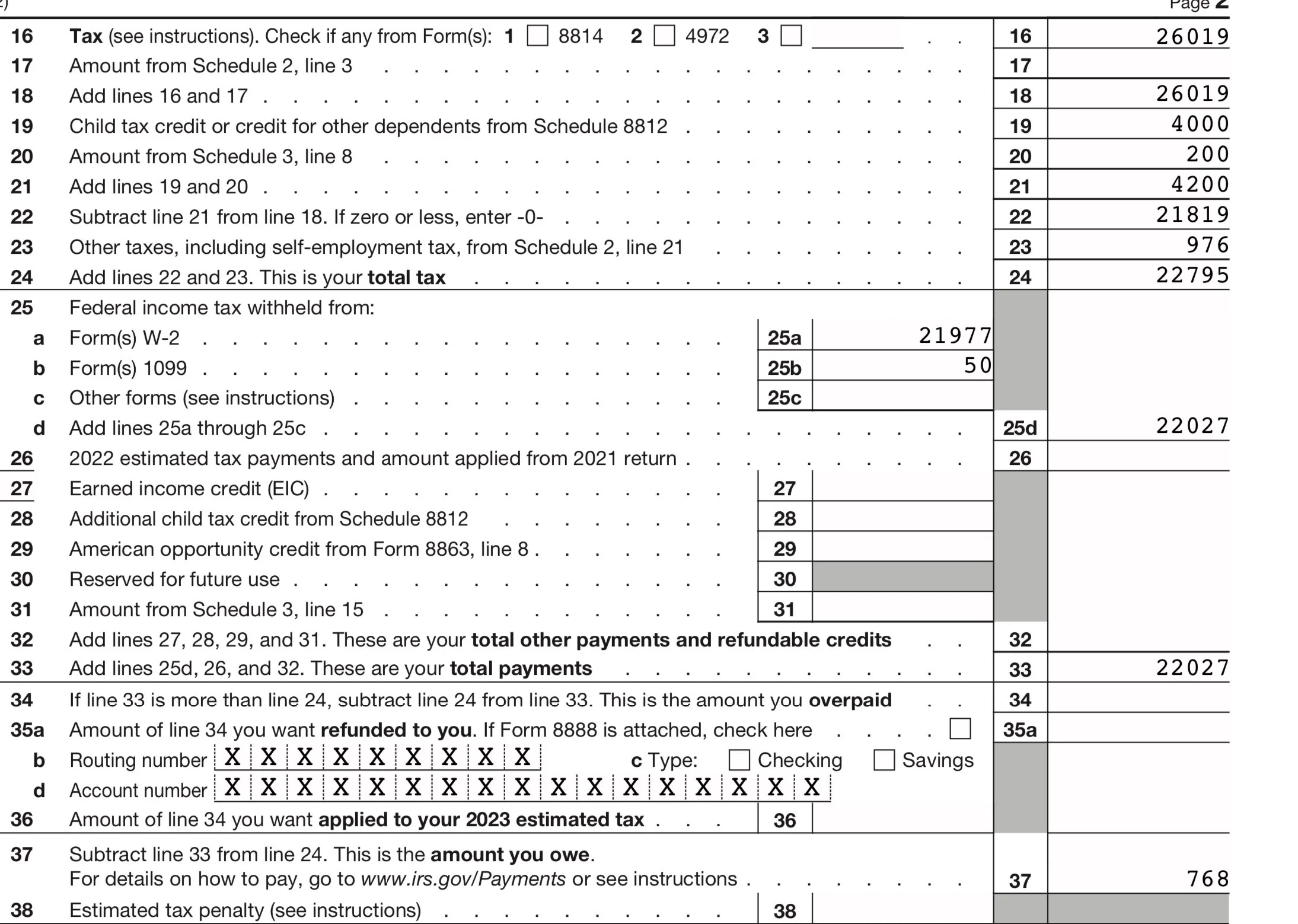

For example, look at last year’s tax return and find the line that says “total tax.” That’s your target number. Then, look at your 2023 W2s. How much federal tax was withheld? Did you pay any estimated taxes? Add those numbers together. How close are you to the 2022 total tax? If the amount you’ve paid in already is more than the 2022 total tax, then you are “safe” and probably don’t need to pay in more with your extension (unless your 2023 income was significantly higher). If the amount you’ve paid in is less than the 2022 tax, then the balance is what you need to aim for.

If your income is significantly higher this year than last year, then you will need to do a bit more calculating. The 100% of last year’s tax safe harbor may not cover you. Estimate how much more your income is than last year, multiply it by 25% and add that to the amount you should pay. It’s not precise, but it will get you closer.

Myth Busting

You are NOT more likely to be audited if you file an extension. The IRS doesn’t care. They just want the money.

If you don’t have the money to pay your taxes, file the extension ANYWAY. There are two penalties the IRS can impose on you – a failure to pay and a failure to FILE. The failure to file penalty is MORE. File the extension. File the tax return. Then worry about paying.

How to file a tax extension

Submit Form 4868 to the IRS either electronically or via mail by the April tax filing deadline.

Here are a few common ways to file a tax extension:

Tax preparer: If you plan to work with a tax pro, ask if they can file for an extension on your behalf. I do file extensions for my clients upon request. (I do not automatically file extensions for clients I haven’t heard from.)

IRS Free File: The IRS partners with a nonprofit organization to provide people who have an adjusted gross income of $79,000 or less access to free, name-brand tax-prep software through Free File. Anybody — even people above the income threshold — can go to the IRS website to file a free extension online.

Tax software: If you plan to use tax software, most have an option for filing Form 4868 for tax extensions.

By mail: You can apply for a tax extension on paper by filling out Form 4868 and sending it to the IRS via snail mail. Make sure to get proof that you mailed it, though, and it must be postmarked by April 15. You can mail a check with the form to pay any taxes.

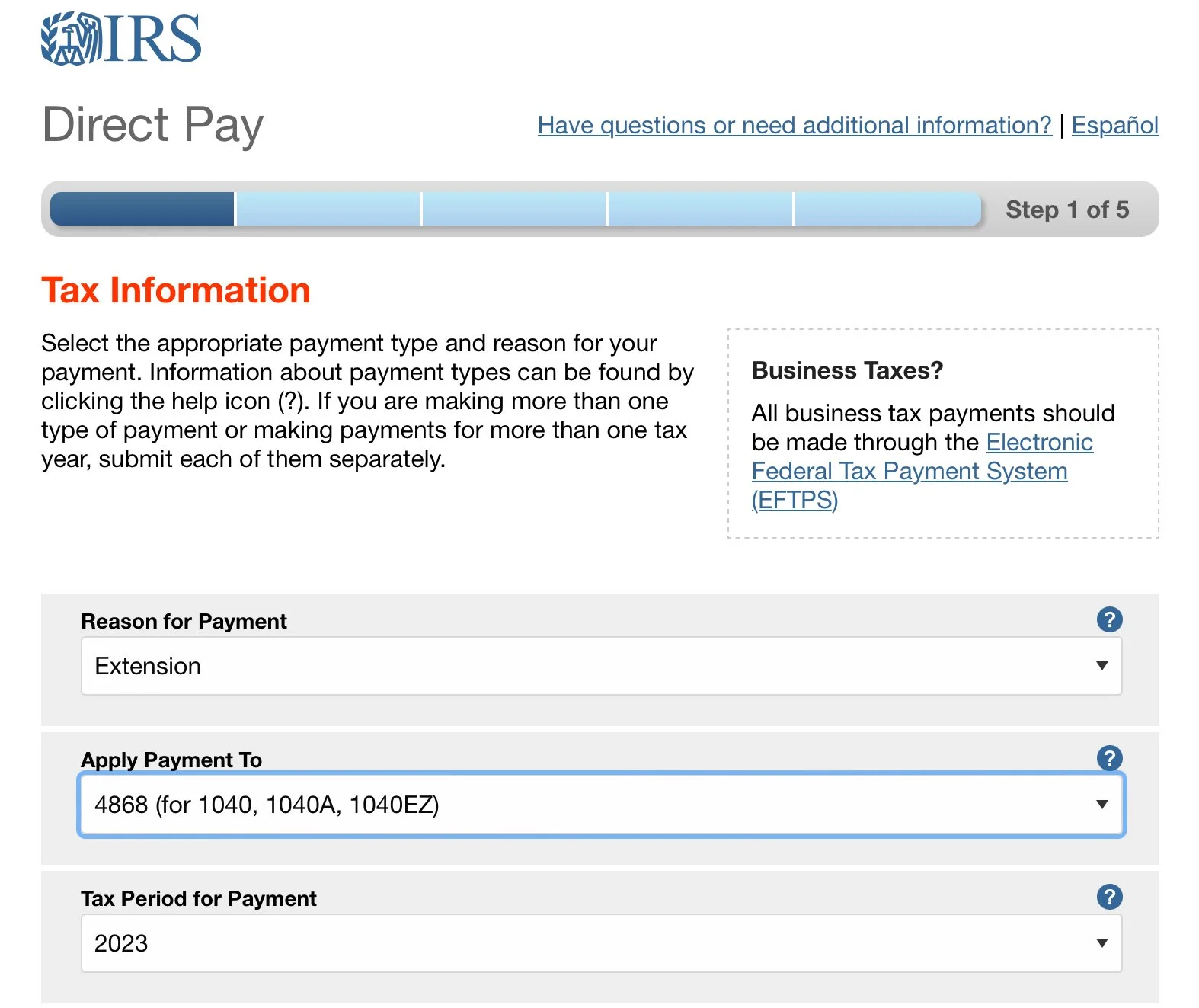

Pay an amount towards your taxes online: Go to irs.gov/pay and choose Direct Pay. From the drop-down menus choose “Extension”. This will automatically file the extension with your payment.

DISCLAIMER: This post is for informational purposes only. Even if you pay in an amount by April 15 or if you determine you don’t need to make a payment, there is no guarantee that you won’t still owe taxes when you file your return, OR that you won’t have any penalties. After all, you are estimating the closest amount possible to what you may owe. However, if you make a payment and still owe more when you file, you have minimized your risk of penalties or reduced the amount of any penalties, so it is worth the effort!